第44届摩根大通医疗健康年会(J.P.Morgan Healthcare Conference)于1月12-15日在美国旧金山成功举办。作为全球医疗健康领域最具影响力的年度盛会之一,JPM大会被视为全球资本市场与产业界观察医药创新趋势的重要窗口。本次大会吸引了来自全球8000余位行业领袖及新兴公司及创新技术的创造者、投资者齐聚旧金山。复星医药子公司复宏汉霖(2696.HK)执行董事兼首席执行官朱俊博士于当地时间1月15日在大会上发表主题演讲,系统阐述了公司在全球化2.0阶段的战略路径、创新管线布局及未来中长期发展蓝图。

面向2030的国际化生物制药愿景

基于不断扩展的创新管线和加速推进的全球化布局,朱俊博士在演讲中阐述了复宏汉霖作为一家国际化生物制药公司的中长期发展愿景。截至目前,复宏汉霖已有10款产品在全球多个国家和地区获批上市,覆盖60个市场,惠及患者人数超95万,海外市场拓展步伐持续加快。预计到2030年,公司计划在全球范围内上市超过20款产品,其中在美国和欧洲上市产品有望超过15款。未来,公司将持续推动更多ADC、多抗及TCE等创新分子走向临床与商业化,产品覆盖肿瘤、自免、代谢及中枢神经系统等多个疾病领域。同时,随着全球商业化能力的不断增强,公司海外收入有望进一步增长,进一步夯实其作为国际化生物制药公司的规模基础与全球竞争力。

五大核心竞争力夯实全球化根基

在本次大会上,朱俊博士重点展示了复宏汉霖在全球化进程中的持续增长路径与“全球化 2.0”阶段性布局,他表示:“随着多款产品相继在欧洲及美国获批上市,公司海外业务保持高速增长,‘体系出海’的能力日益完善,呈现出强劲的发展势头。依托一体化研发、注册与生产体系,以及日益成熟的全球临床和商业化网络,我们已经具备向全球持续输出创新资产的系统能力。未来五年,公司将通过生物类似药带来的稳定现金流,反哺创新研发,推动更多ADC、多抗及TCE等差异化分子进入全球市场,构建可持续、可复制的国际化增长模式。”

当前,复宏汉霖已构建覆盖研发、临床、注册、生产及商业化的一体化生物制药平台。在研发方面,公司已前瞻性布局涵盖50余个早期分子的多元化高质量管线,其中约70%聚焦同类最佳(BIC),15%聚焦同类首创(FIC)。在临床运营方面,公司已在中国、美国及其他地区建立自有临床团队,全球临床团队规模近600人,临床研究网络覆盖20多个国家、1000余家研究中心,具备独立开展国际多中心临床试验的能力。在注册层面,公司具备与全球主要监管机构直接沟通的能力,目前累计获得全球164项IND批准、66项NDA批准,并已有4项生物制品许可申请(BLA)获得美国FDA批准,持续验证其国际注册与质量管理能力。在生产与质量体系方面,公司商业化生产已累计完成1150余批GMP生产批次,生产基地通过中国、欧盟及美国等多个国家和地区的GMP认证,为产品在全球市场的稳定供应提供有力保障。在商业化层面,公司在中国境内已建立起约1600人的肿瘤商业化团队,在海外与超过20家合作伙伴签订商业化合作协议,产品已在全球约60个国家和地区上市销售。

核心创新资产:

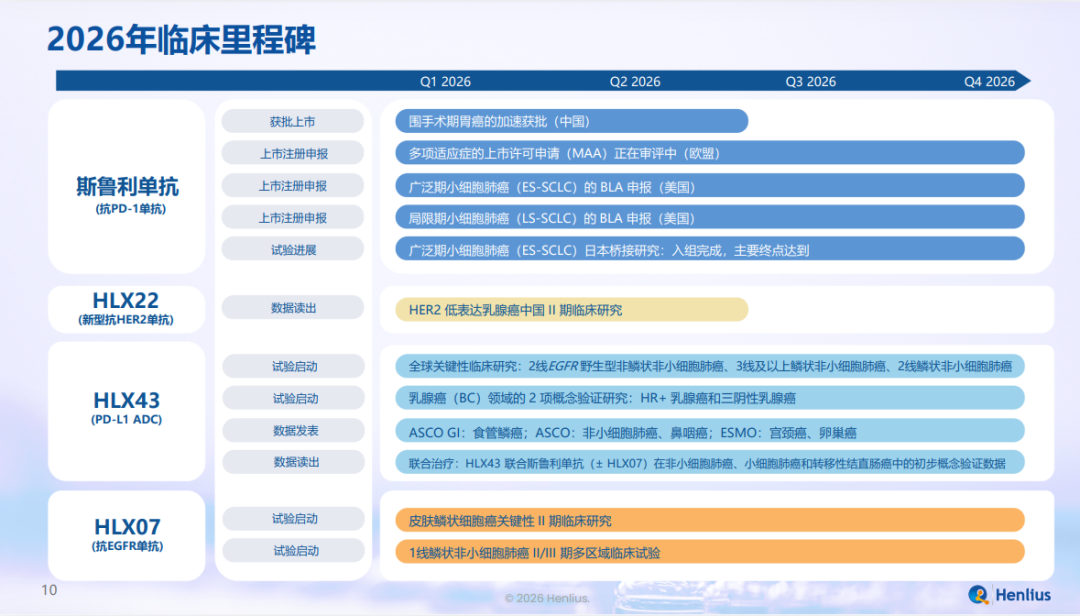

2026关键临床与注册里程碑明确

此外,公司亦围绕其关键创新资产在2026年的关键临床与注册里程碑,在大会上系统披露了多项明确的时间表与推进计划。

抗PD-1单抗 H药汉斯状?(斯鲁利单抗,欧洲商品名:Hetronifly?)

目前已在全球40余个市场获批,有望在2026年底前完成:

胃癌围术期适应症在中国的加速获批;

广泛期小细胞肺癌(ES-SCLC)和局限期小细胞肺癌(LS-SCLC)适应症在美申报上市;

多项新适应症在欧盟获批上市;

ES-SCLC适应症在日本桥接试验的入组完成,并达到主要研究终点。

具备差异化机制的新表位HER2单抗HLX22,有望在2026年上半年前完成在中国境内开展的治疗HER2低表达乳腺癌的II期临床研究数据读出。

高效、低毒、兼具IO功效,潜在同类最优(BIC)的“药丸管线(pipeline-in-a-pill)” PD-L1 ADC HLX43,有望在2026年底前:

启动二线治疗EGFR野生型非鳞状非小细胞肺癌(nsqNSCLC)、三线及后线治疗鳞状非小细胞肺(sqNSCLC)以及二线治疗sqNSCLC的三项全球关键临床研究;

启动治疗HR阳性乳腺癌及三阴性乳腺癌的两项概念验证(PoC)研究;

于重要学术会议发表在食管鳞癌、NSCLC、鼻咽癌、宫颈癌、卵巢癌等领域的临床研究数据(治疗食管鳞癌的研究数据已于近日在ASCO GI 2026大会上公布);

完成联合H药±HLX07治疗NSCLC、SCLC及转移性结直肠癌的前瞻性PoC研究数据读出。

具有双靶点协同效应,有望开辟EGFR高表达肺鳞癌一线治疗新路径的抗EGFR单抗HLX07,有望在2026年底前启动两项临床研究:

用于皮肤鳞状细胞癌的关键II期临床研究;

用于一线sqNSCLC的国际多中心II/III期临床研究。

平台化创新体系驱动持续产出,

多元潜力分子构建下一代创新梯队

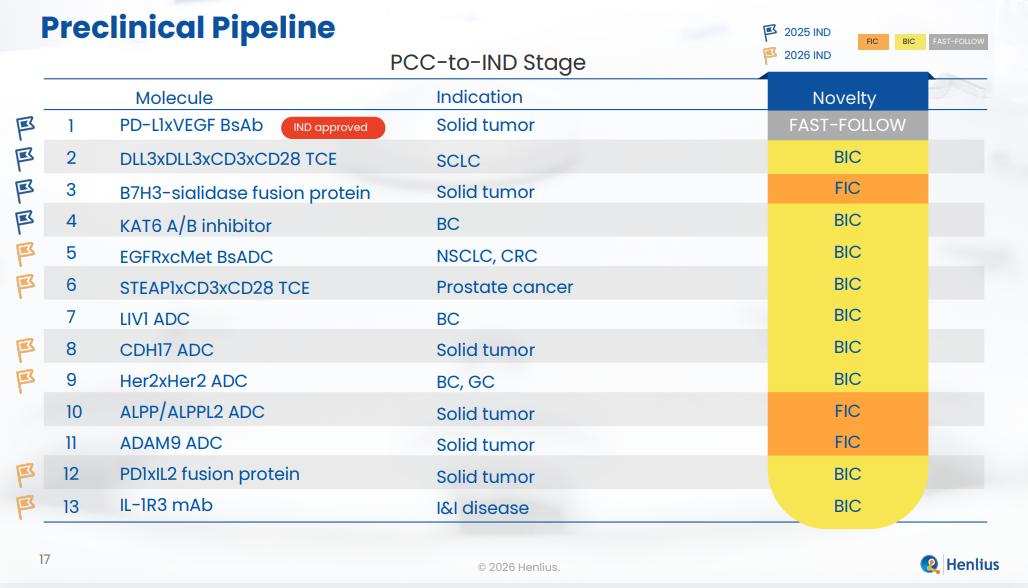

复宏汉霖系统化、平台化的创新研发体系正持续高效地产出具有差异化价值的候选药物。未来五年内,公司预计将有超过40项新的临床研究申请获批。目前,从早期靶点筛选、验证,候选分子设计与优化,到系统性地临床前开发,公司已搭建起包括PD-(L)1为核心的免疫检查点抑制剂平台、免疫细胞衔接器平台(如多特异性TCE平台)、Hanjugator? ADC 平台、AI驱动的一站式早期研发平台HAI Club在内的多维创新平台矩阵,不仅保障了单个项目的研发质量与效率,更关键的是为打造具备全球竞争力的中长期创新管线提供了可持续的系统能力支撑,从而能够持续、高效地将前沿科学发现转化为具有临床价值的候选药物。

HLX37(PD-L1 x VEGF双抗):基于免疫检查点抑制剂平台开发,具有较高的PD-L1亲和力,且与联合疗法相比,肿瘤微环境富集度更高,有望成为继H药之后的新一代免疫治疗药物。

HLX97(新型KAT6A/B口服小分子抑制剂):潜在BIC,有望广泛适用于乳腺癌、去势抵抗性前列腺癌和NSCLC等肿瘤的治疗。

HLX3901(DLL3 x DLL3 x CD3 x CD28四特异性TCE):基于自研T细胞衔接器(TCE)平台开发,拥有更长的T细胞激活持续时间以及在实体瘤治疗中更好的疗效。

HLX3902(STEAP1 x CD3 x CD28三特异性TCE):基于自研TCE平台开发的潜在同类首创(FIC),拥有更好的抗肿瘤活性,并能增强T细胞在肿瘤微环境中的浸润和持久性。

HLX316(新型B7H3-唾液酸酶融合蛋白):基于合作伙伴Palleon Pharmaceuticals的EAGLE平台开发的潜在FIC,可去除肿瘤细胞上的唾液酸以增强免疫反应。

HLX48(cMET x EGFR ADC):基于Hanjugator? ADC 平台开发,具有更安全、有效的潜质,可最大限度发挥抗体功能,并具备更强的旁观者效应,有望用于NSCLC和结直肠癌的治疗。

HLX49(新型HER2双表位ADC):基于Hanjugator? ADC 平台开发的潜在BIC,具有更好的疗效、更高的耐受性和安全性,能最大程度发挥抗体功能。

当前,公司临床前项目资产覆盖抗体、多特异性T细胞衔接器(TCE)、抗体偶联药物(ADC)、融合蛋白及小分子等多种分子形式,主要聚焦实体瘤,围绕PD-(L)1、DLL3、B7H3、HER2、EGFR、cMet、KAT6A/B等成熟与新兴靶点展开差异化开发,既包含潜在FIC与BIC分子,也涵盖具备临床与产业化确定性的快速跟进(Fast-follow)项目,为中长期临床管线的持续推进奠定基础。通过在临床前阶段前瞻性布局涵盖FIC、BIC及Fast-follow等不同创新类型,形成梯队化研发结构,复宏汉霖在持续探索前沿创新的同时,兼顾研发效率与风险管理,为创新管线的持续推进奠定基础。

关于复宏汉霖

复宏汉霖(2696.HK)是一家国际化的创新生物制药公司,致力于为全球患者提供可负担的高品质生物药,产品覆盖肿瘤、自身免疫疾病、眼科疾病等领域,已在全球获批上市10款产品,5个上市申请分别获中国药监局和欧盟EMA受理。自2010年成立以来,复宏汉霖已建成一体化生物制药平台,高效及创新的自主核心能力贯穿研发、生产及商业运营全产业链。公司已建立完善高效的全球创新中心,按照国际药品生产质量管理规范(GMP)标准进行生产和质量管控,不断夯实一体化综合生产平台,其中,公司商业化生产基地已相继获得中国、欧盟和美国GMP认证。

复宏汉霖前瞻性布局了一个多元化、高质量的产品管线,涵盖约50个分子,并全面推进基于自有抗PD-1单抗H药汉斯状?的肿瘤免疫联合疗法。截至目前,公司已获批上市产品包括全球首个获批一线治疗小细胞肺癌的抗PD-1单抗汉斯状?(斯鲁利单抗,欧洲商品名:Hetronifly?)、自主研发的中美欧三地获批单抗生物类似药汉曲优?(曲妥珠单抗,美国商品名:HERCESSI?,欧洲商品名:Zercepac?)、国内首个生物类似药汉利康?(利妥昔单抗)、地舒单抗生物类似药Bildyos?和Bilprevda?,以及帕妥珠单抗POHERDY?。公司亦同步就19个产品在全球范围内开展30多项临床试验,对外授权全面覆盖欧美主流生物药市场和众多新兴市场。

复宏汉霖前瞻性声明

上海复宏汉霖生物技术股份有限公司(简称“公司”,连同其控股子公司合称“本集团”)特此提供以下警示性声明:本文件包含有关本集团运营、业绩及财务状况的某些前瞻性陈述,其中可能包括但不限于有关预期或目标收入、利润率、每股收益或其他财务或非财务指标,以及本集团在研产品及其预期开发进度、监管审批时间表和商业化时间表(包括本文件所述“财务目标陈述”(定义见下文))的陈述。尽管本集团相信其预期和目标基于合理假设,并采用了生物制药行业惯用的预测方法及针对个别产品的风险调整预测(该方法考虑了基于行业范围内处于相似开发阶段的相关临床试验数据得出的个别临床试验成功概率),但任何前瞻性陈述本质上均涉及风险和不确定性,并可能受到某些因素的影响,导致实际结果与预测结果存在重大差异。前瞻性述反映了本文件编制之日可获得的知识和信息,本集团无义务更新这些前瞻性陈述。本集团通过在此类陈述中使用“预期”、“相信”、“期望”、“打算”及类似表述来标识前瞻性陈述。本文件中包含的某些非历史事实陈述亦构成前瞻性陈述,即使该等陈述未被明确标识。可能导致实际结果与前瞻性陈述所含内容出现重大差异的重要因素(其中某些因素超出本集团控制范围)包括但不限于:在研产品交付或新产品上市失败或延迟的风险(鉴于本集团大多数候选药物仍处于开发阶段(包括临床开发阶段),而临床开发过程漫长且昂贵,各方面存在不确定性,本集团无法保证其开发和临床结果,且若候选药物的临床开发和监管审批进程延迟或终止,可能对本集团候选药物的成功开发和及时商业化产生不利影响);未能满足药物开发或审批的监管或伦理要求的风险;本集团商业策略的执行质量不佳或执行失败或延迟的风险;在适应症治疗、药物新颖性、药物质量与声誉、药物产品组合广度、生产与分销能力、药品价格、客户覆盖广度与深度、消费者行为及供应链关系等多种因素上面临全球制药公司的定价、可及性、准入及竞争压力的风险;对本集团不利的政策风险,可能包括中华人民共和国相关集中采购政策的推进和实施;未能持续供应合规、优质产品的风险;本集团产品贸易的风险;依赖第三方商品和服务的影响;信息技术或网络安全故障的风险;关键流程失败的风险;未能按照法律法规要求和战略目标收集和管理数据的风险;未能吸引、发展、激励和保留多元化、有才华且有能力的员工队伍的风险;未能满足有关环境影响(包括气候变化)的监管或伦理期望的风险;上市产品的安全性和有效性受到质疑的风险;诉讼和/或政府调查出现不利结果的风险;本集团产品相关的知识产权风险;未能实现战略计划或达到目标或预期的风险;财务控制风险;本集团财务状况意外恶化的风险;任何自然灾害或其他意外灾难性事件(如地震、火灾、恐怖袭击和战争)的风险;以及全球和/或地缘政治事件可能已经或持续对这些风险、对本集团持续缓解这些风险的能力以及对本集团运营、财务业绩或财务状况产生的影响。无法保证公司的在研产品将获得必要的监管批准、成功开发、生产或商业化。本演示文稿包含对当前或未来临床试验中进行研究的尚未获得任何监管机构的批准的产品管线的引用。有关本集团最新产品组合和在研管线,请参见复宏汉霖官方网站:http://www.henlius.com。

本文件中公司目标、预测和指标(简称“财务目标陈述”)的基础源自公司最新的经考虑风险调整的中长期计划,并根据该计划定稿后的业务发展情况进行了调整。所呈列的财务目标陈述基于管理层对各产品和各临床试验的经考虑风险调整后的预测。估算基于生物制药行业处于相似开发阶段的相关临床试验的行业数据,并根据管理层对特定资产风险状况的看法进行了调整。估算基于生物制药行业惯用的预测方法。生物制药产品的开发具有源自科学实验过程的固有风险,在临床结果、安全性、有效性和药品说明书等方面,可能存在多种可能的状况。临床结果可能无法达到预期的产品特性和竞争环境的要求;定价和报销政策可能对商业收入预测产生重大影响。就其性质而言,预测基于多重假设,未来几年的实际表现可能与这些假设存在显著且重大的差异。本文件中的财务目标陈述基于所述汇率。所有后续由公司或代表其行事的任何人士作出的书面或口头前瞻性陈述,均受上述警示性声明的明确全面限定。公司无义务根据未来的汇率变动更新这些陈述。本文件不构成任何证券的出售要约或购买要约的招揽,也不得在任何该等要约、招揽或销售在该司法管辖区证券法下注册或资格认定之前为非法的司法管辖区内进行任何证券的要约、招揽或销售。通过参加与本文件相关的演示会议或阅读本文件,即表示您同意受上述限制的约束。

Henlius Showcases “Globalisation 2.0” Strategy and Mid-to-Long-Term Innovation Blueprint at JPM 2026

The 44th J.P.Morgan Healthcare Conference (JPMHC) was successfully held in San Francisco, the United States, from January 12 to 15. As one of the most influential annual events in the global healthcare sector, JPM serves as a key platform for the capital markets and industry leaders to observe emerging trends in pharmaceutical innovation and industry development. The conference attracted more than 8000 global industry leaders, innovators, entrepreneurs, and investors. On January 15 (PST), Dr. Jason Zhu, Executive Director and Chief Executive Officer of Shanghai Henlius Biotech, Inc.(2696.HK), delivered a keynote presentation outlining Henlius’“Globalisation 2.0” strategy, diversified innovation pipeline, and its mid-to-long-term development blueprint.

A Global Biopharmaceutical Vision Toward 2030

Building on its expanding innovation pipeline and accelerating global footprint, Dr. Zhu shared Henlius’ mid-to-long-term vision as a global biopharmaceutical company. To date, Henlius has achieved regulatory approvals for 10 products across 60 markets worldwide, benefiting more than 950,000 patients globally. The Company’s international business continues to grow at a rapid pace. Looking ahead to 2030, Henlius anticipates to launch more than 20 products globally, including over 15 products in the U.S. and European markets. The Company will continue to advance innovative modalities such as ADCs, multi-specific antibodies and T-cell engagers (TCEs), covering oncology, autoimmune, metabolic and central nervous system (CNS) diseases. With the continued strengthening of its global commercialisation capabilities, international market revenue is expected to grow further, reinforcing Henlius’ global scale and competitiveness as a global biopharma.

Five Core Capabilities Strengthen the Globalisation Foundation

Dr. Zhu highlighted Henlius’ continuous growth trajectory and phased achievements under its “Globalisation 2.0” strategy:

“With multiple products approved successively in Europe and the United States, and an increasingly mature integrated global operating model, our international business has maintained strong growth momentum. Leveraging our integrated R&D, regulatory and manufacturing capabilities, together with an increasingly mature global clinical and commercialisation network, we have established a systematic capacity to continuously deliver innovative assets worldwide. Over the next five years, stable cash flows from our biosimilar portfolio will further support innovation investment, enabling the advancement of more differentiated molecules, including ADCs, multi-Abs and TCEs, into global markets and building a sustainable, replicable globalisation growth model.”

Henlius has established a fully integrated biopharmaceutical platform covering R&D, clinical operations, regulatory affairs, manufacturing and commercialisation. In R&D, the Company has built a diversified pipeline of more than 50 early-stage assets, with approximately 70% classified as best-in-class (BIC) and 15% as first-in-class (FIC). In clinical operations, it operates in-house global clinical teams across China, the United States and other regions, with nearly 600 professionals supporting clinical development in more than 20 countries and over 1000 research centres worldwide, possessing the capability to independently conduct international multicentre clinical trials. In regulatory affairs, the Company has secured a total of 164 IND approvals and 66 New Drug Application (NDA) approvals globally, including 4 Biologics License Application (BLA) approvals from the U.S. FDA, continuously validating its international regulatory and quality management capabilities. In manufacturing and quality, it has completed over 1150 commercial GMP batches, with production facilities certified by regulatory authorities in China, the European Union, the United States and many other countries, providing a strong guarantee for the stable supply of products in the global market. In commercialisation, the company has established a strong oncology-focused commercial team of approximately 1600 professionals in China, while working with more than 20 international commercialisation partners, with its products now marketed in approximately 60 countries and regions.

Core Innovation Assets: Clear 2026 Clinical and Regulatory Milestones

Henlius also outlined clear timelines and development plans for its key innovation assets in 2026:

Serplulimab (trade name: Hetronifly? in Europe)– Anti-PD-1 mAb

Approved in over 40 markets globally. By the end of 2026, Henlius expects to achieve:

Accelerated approval for perioperative treatment of gastric cancer in China;

U.S. BLA filings for extensive-stage and limited-stage small cell lung cancer (ES-SCLC and LS-SCLC);

Approval of various indications in the EU;

Completion of enrolment and achievement of primary endpoints in the Japanese bridging study for ES-SCLC.

HLX22 – Novel Epitope Anti-HER2 mAb with a Differentiated Modality

Phase 2 data readout in HER2-low breast cancer in China is expected in the first half of 2026.

HLX43 – PD-L1 ADC (“Pipeline-in-a-Pill”) with High-Efficacy, a Favourable Safety Profile and I/O Effects, Potential BIC

By the end of 2026, Henlius anticipates to:

Initiate three global pivotal trials in second-line EGFR wild-type nsqNSCLC, third-line and later sqNSCLC, and second-line sqNSCLC;

Launch two PoC trials in HR-positive and triple-negative breast cancer;

Present clinical data across ESCC, NSCLC, NPC, cervical and ovarian cancers at major congresses (ESCC data were recently presented at ASCO GI);

Complete PoC readouts of combination trials with serplulimab ± HLX07 in NSCLC, SCLC and mCRC.

HLX07 – Anti-EGFR mAb with a Dual-Target Synergistic Effect, Expected to Open Up a New First-Line treatment Pathway for EGFR-overexpressing sqNSCLC

Two studies are planned by the end of 2026:

A pivotal Phase 2 trial in cutaneous squamous cell carcinoma;

A global multicentre Phase 2/3 trial in first-line sqNSCLC.

Platform-Driven Innovation Ensures Sustained Output, Building a Next-Generation Pipeline of High-Potential Assets

Henlius’ systematic, platform-based R&D ecosystem continues to generate differentiated innovation candidates. Over the next five years, the Company expects more than 40 new clinical trial applications. At present, the company has established a multi-dimensional innovation platform matrix covering the entire early R&D continuum, from early-stage target screening and validation, to candidate molecule design and optimisation, and through to systematic preclinical development. This integrated platform ecosystem includes a PD-(L)1-centred immune checkpoint inhibitor platform, immune cell engager platforms such as multi-specific T-cell engagers (TCEs), the Hanjugator? ADC platform, and the AI-driven one-stop early discovery platform HAI Club. These platforms not only ensure the quality and efficiency of individual R&D programs, but more importantly provide a sustainable, system-level capability to support the development of a globally competitive mid- to long-term innovation pipeline. As a result, the company is able to continuously and efficiently translate cutting-edge scientific discoveries into clinically valuable drug candidates.

Key early-stage assets include:

HLX37:PD-L1 × VEGF bispecific antibody developed based on the immune checkpoint inhibitor platform. It demonstrates high PD-L1 binding affinity and achieves higher tumour microenvironment (TME) enrichment vs. combination therapies, positioning it as a next-generation immunotherapy candidate following serplulimab.

HLX97: Novel oral small-molecule KAT6A/B inhibitorwith potential BIC profile, broadly applicable for the treatment of breast cancer, castration-resistant prostate cancer, and NSCLC.

HLX3901: DLL3 × DLL3 × CD3 × CD28 tetravalent TCE developed on the Company’s proprietary TCE platform, featuring longer persistence of activated T cells and greater efficacy in solid tumour treatment.

HLX3902: Potential FIC STEAP1 × CD3 × CD28 trispecific TCE developed on the proprietary TCE platform, demonstrating superior antitumour activity, and increased T-cell infiltration and persistence in TME.

HLX316: Novel potential FIC B7-H3–sialidase fusion protein developed based on Palleon Pharmaceuticals’ EAGLE platform, designed to remove tumour sialic acid to enhance immune response.

HLX48: Safer and more effective cMET x EGFR ADC developed on the Hanjugator? ADC platform, designed to maximize antibody function while delivering a stronger bystander effect, for the treatment of NSCLC and colorectal cancer.

HLX49: Potential BIC HER2xHER2 novel bi-paratopic ADC developed on the Hanjugator? ADC platform, offering improved efficacy, higher and safer tolerance, and maximized function of antibodies.

At present, the Company’s preclinical asset portfolio spans multiple molecular modalities, including antibodies, multispecific TCEs, ADCs, fusion proteins and small molecules, with a primary focus on solid tumors. Its differentiated development strategy targets both established and emerging targets such as PD-(L)1, DLL3, B7-H3, HER2, EGFR, c-Met and KAT6A/B. The portfolio comprises a balanced mix of potential FIC and BIC candidates, as well as fast-follow programs with higher clinical and commercialisation certainty, laying a solid foundation for the sustained advancement of the mid- to long-term clinical pipeline. By proactively structuring its preclinical portfolio to encompass diverse innovation profiles including FIC, BIC and fast-follow programs, the company has established a tiered R&D architecture that balances frontier innovation with development efficiency and risk management, thereby supporting the continuous progression of its innovation pipeline.

About Henlius

Henlius (2696.HK) is a global biopharmaceutical company with the vision to offer high-quality, affordable and innovative biologic medicines for patients worldwide with a focus on oncology, autoimmune diseases and ophthalmic diseases. To date, 10 products have been approved for marketing across multiple countries and regions, and 5 marketing applications have been accepted for review in China and the EU, respectively. Since its inception in 2010, Henlius has built an integrated biopharmaceutical platform with core capabilities of high-efficiency and innovation embedded throughout the whole product life cycle including R&D, manufacturing and commercialization. It has established global innovation centre and Shanghai-based commercial manufacturing facilities certificated by China, the EU and U.S. GMP.

Henlius has pro-actively built a diversified and high-quality product pipeline covering about 50 molecules and has continued to explore immuno-oncology combination therapies with proprietary HANSIZHUANG (anti-PD-1 mAb) as the backbone. To date, the company''s launched products include HANSIZHUANG (serplulimab, trade name: Hetronifly? in Europe), the world’s first anti-PD-1 mAb for the first-line treatment of SCLC, HANQUYOU (trastuzumab, trade name: HERCESSI? in the U.S., Zercepac? in Europe), a China-developed mAb biosimilar approved in China, Europe and U.S., HANLIKANG (rituximab), the first China-developed biosimilar, denosumab Bildyos? and Bilprevda?, and pertuzumab Poherdy?. What’s more, Henlius has conducted over 30 clinical studies for 19 products, expanding its presence in major markets as well as emerging markets.

To learn more about Henlius, visit https://www.henlius.com/en/index.html and connect with us on LinkedIn at https://www.linkedin.com/company/henlius/.

Henlius’ Forward Looking Statements

Shanghai Henlius Biotech, Inc.(the “Company”, together with its subsidiaries, the “Group”) provides the following cautionary statement: This document contains certain forward-looking statements with respect to the operations, performance and financial condition of the Group, including, among other things, statements about expected or targeted revenues, margins, earnings per share or other financial or other measures, as well as the Group’s pipeline products and their expected development, regulatory approval and commercialisation timelines (including the Financial Ambition Statements (as defined below) described in this document). Although the Group believes its expectations and targets are based on reasonable assumptions and has used customary forecasting methodologies used in the biopharmaceutical industry and risk-adjusted projections for individual products (which take into account the probability of success of individual clinical trials, based on industry-wide data for relevant clinical trials at a similar stage of development), any forward-looking statements, by their very nature, involve risks and uncertainties and may be influenced by factors that could cause actual outcomes and results to be materially different from those predicted. The forward-looking statements reflect knowledge and information available at the date of preparation of this document and the Group undertakes no obligation to update these forward-looking statements. The Group identifies the forward-looking statements by using the words ''anticipates'',''believes'',''expects'',''intends'' and similar expressions in such statements. Certain statements contained in this document that are not statements of historical fact constitute forward-looking statements, notwithstanding that such statements are not specifically identified. Important factors that could cause actual results to differ materially from those contained in forward-looking statements, certain of which are beyond the Group’s control, include, among other things: the risk of failure or delay in delivery of pipeline or launch of new products, considering that most of the Group’s drug candidates are still under development and are in the clinical development stages, and the course of clinical development involves a lengthy and expensive process with uncertainties in various aspects, as there can be no assurance from the Group for the development and clinical results, and that if the clinical development and regulatory approval process of the drug candidates are delayed or terminated, the successful development and commercialisation of the Group’s drug candidates in a timely manner may be adversely affected; the risk of failure to meet regulatory or ethical requirements for medicine development or approval; the risk of failures or delays in the quality or execution of the Group’s commercial strategies; the risk of pricing, affordability, access and competitive pressures from pharmaceutical companies around the world in respect of various factors such as indication treatment, drug novelty, drug quality and reputation, breadth of drug portfolio, manufacturing and distribution capacity, drug price, breadth and depth of customer coverage, consumer behaviour and supply chain relationships; the risk of unfavourable policies to the Group, which may include the advancement and implementation of the relevant centralised procurement policies in the People’s Republic of China; the risk of failure to maintain supply of compliant, quality products; the risk of illegal trade in the Group’s products; the impact of reliance on third-party goods and services; the risk of failure in information technology or cybersecurity; the risk of failure of critical processes; the risk of failure to collect and manage data in line with legal and regulatory requirements and strategic objectives; the risk of failure to attract, develop, engage and retain a diverse, talented and capable workforce; the risk of failure to meet regulatory or ethical expectations on environmental impact, including climate change; the risk of the safety and efficacy of marketed products being questioned; the risk of adverse outcome of litigation and/or governmental investigations; intellectual property-related risks to the Group’s products; the risk of failure to achieve strategic plans or meet targets or expectations; the risk of failure in financial control or the occurrence of fraud; the risk of unexpected deterioration in the Group’s financial position; the risk of any natural disasters or other unanticipated catastrophic events such as earthquakes, fires, terrorist attacks and wars; and the impact that global and/or geopolitical events may have, or continue to have, on these risks, on the Group’s ability to continue to mitigate these risks, and on the Group’s operations, financial results or financial condition. There can be no guarantees that the Company’s pipeline products will receive the necessary regulatory approvals, be successfully developed, manufactured, or commercialised. This presentation includes references to pipeline products that are being investigated in current or future clinical trials, and as such have not been approved by any regulatory agency. For the Group’s latest product portfolio and pipeline, see Henlius official website: http://www.henlius.com.

The basis of the Company’s ambitions, forecasts and targets in this document (the “Financial Ambition Statements”) is derived from the Company’s most recent risk-adjusted mid- and long-term plans, adjusted for developments in the business since those plans were finalised. Financial Ambition Statements presented are based on management’s risk-adjusted projections for individual products and individual clinical trials. Estimates for these probabilities are based on industry-wide data for relevant clinical trials in the biopharmaceutical industry at a similar stage of development adjusted for management''s view on the risk profile of the specific asset. Estimates are based on customary forecasting methodologies used in the biopharmaceutical industry. The development of biopharmaceutical products has inherent risks given scientific experimentation and there are a range of possible outcomes in clinical results, safety, efficacy and product labelling. Clinical results may not achieve the desired product profile and competitive environment; pricing and reimbursement may have material impact on commercial revenue forecasts. By their nature, forecasts are based on a multiplicity of assumptions and actual performance in future years may vary, significantly and materially, from these assumptions. The Financial Ambition Statements in this document are based on stated exchange rates. All subsequent written and oral forward-looking statements attributable to the Company or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements referenced above. The Company undertakes no obligation to update those statements based on future currency movements. This document shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any offer, solicitation or sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of such jurisdiction. By attending the presentation relating to this document, or by reading this document, you agree to be bound by the above limitations.